A contractor in Orange County just finished installing a $12,000 heat pump. The install went clean. Customer's happy. Equipment's humming. Then the real work starts.

The customer qualifies for an $8,000 HEEHRA rebate — half the entire job cost. But to claim it, the contractor needs income verification codes, reservation confirmations, equipment serial photos, nameplate documentation, model number cross-references, AHRI certificate uploads, and deadline tracking. If one form field gets fat-fingered, the customer loses $8,000 and the contractor loses the sale that justified their quote.

California just allocated $290 million in federal IRA funds for heat pump rebates. Individual rebates hit $4,000 to $8,000 per household. TECH Clean California's HEEHRA program launched in November 2024, and by January 2026, most regional budgets hit "fully reserved" status. Central and Southern California are already closed. Northern California is weeks away.

The money is massive. The window is closing. The compliance requirements are getting stricter, not simpler. Contractors are drowning in paperwork more complex than the actual install.

Why this pain is real (and getting sharper)

The dollars are big and highly conditional

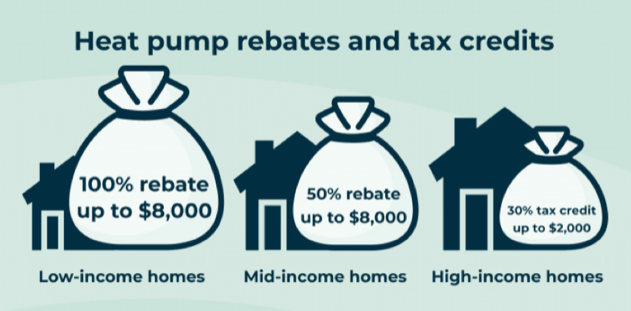

HEEHRA delivers up to $8,000 for households under 80% area median income and $4,000 for moderate-income households (80-150% AMI) when replacing primary heating with a qualified heat pump. These aren't mail-in rebates. They work as instant invoice discounts or post-install reimbursements, making them genuine closing leverage at the kitchen table.

Stack those with TECH Clean California's single-family heat pump incentives ($1,000-$4,000) and the expiring federal 25C tax credit (up to $2,000, ending December 31, 2025), and a single heat pump install can carry $6,000-$10,000 in combined incentives. For a $15,000 system, that's half the ticket.

The catch: the rebate isn't approved until TECH confirms the reservation. Reservations require pre-approved income verification codes, equipment eligibility validation, and contractor certification. Sell the job before the reservation clears? Program rules explicitly warn that "misrepresenting the program or failure to comply with this requirement could result in the contractor's removal from the TECH Clean California and HEEHRA Phase I programs."

Promise an $8,000 rebate you can't guarantee, and you're out of the program. Miss a compliance step, and your customer eats the loss and blames you.

The rules are rigid and punish sloppy operators

HEEHRA follows a strict workflow: income verification → reservation → installation → claim submission. There's no retroactive filing. If the customer starts the install before the reservation is approved, the project becomes ineligible. Period.

California's IRA residential rebate programs received $590 million total from the Department of Energy. The program operates first-come, first-served. When a region hits "fully reserved," that's it. The Southern California single-family budget was exhausted by early 2026. Central California followed within weeks.

Reservation windows are tight. All projects approved after October 15, 2025 must be installed by December 31, 2025, with claims submitted by February 26, 2026. Miss that window and the reservation expires.

The compliance burden doesn't stop at forms. Contractors must complete HEEHRA-specific training to even access the program. Customers must enroll in demand response programs (for TECH incentives) and time-of-use rates (for heat pump water heaters). Equipment must meet ENERGY STAR certification and appear on TECH's Qualifying Product List. Installation requires AHRI certificates, equipment photos, and in some cases, Manual J load calculations.

This isn't filling out a PDF. It's managed workflow across multiple agencies with version-controlled requirements that change quarterly.

California is the preview — the rest of the country is next

California received $590 million total from the Department of Energy for IRA residential rebate programs — $290 million for HEEHRA, $291 million for HOMES (whole-home efficiency), and funding for contractor training. But every state got IRA allocations. Most are still in pre-launch.

The federal 25C tax credit expires December 31, 2025, which means 2026 becomes the year of state-run rebate programs. Contractors who figure out compliance infrastructure now — in California's live-fire environment — will have a 12-month head start when their state's program launches.

Colorado got $140 million. New York is rolling out instant rebates through utility programs. The entire HVAC industry — 117,000 contractors managing a $156 billion market — is about to face the same rebate complexity that California contractors are navigating right now.

California's TECH Clean California is explicitly targeting mass adoption, talking in "millions of heat pumps" by 2030 terms. The infrastructure is scaling. The money is flowing. The compliance burden is real.

Contractors need a TurboTax for heat pump rebates today, not tomorrow.

The bigger prize? Build it correctly and you're not running a forms tool. You're running a vertical compliance operating system for contractors riding the electrification wave.

The play: fast heist vs. long game

This heist has the best of both worlds:

The fast play is a classic micro-SaaS that can be Frankensteined with no-code tools or with a bit of vibe-coding. For builders who want to build a longer runway, the fast heist can be turned into a moat for the long play.

Unlock the Vault.

Join founders who spot opportunities ahead of the crowd. Actionable insights. Zero fluff.

“Intelligent, bold, minus the pretense.”

“Like discovering the cheat codes of the startup world.”

“SH is off-Broadway for founders — weird, sharp, and ahead of the curve.”