A decade ago, "becoming a landlord" meant buying a second property, qualifying for a mortgage, and crossing your fingers on vacancy rates.

In 2026, it means building a unit 20 feet behind your kitchen—and then figuring out how to run it without blowing up your life.

These homeowners-turned-landlords have no idea what they're doing. Traditional property managers won't touch quirky single units. Airbnb optimizes for vacationers, not quiet tenants living 20 feet from someone's kids. And the homeowner is emotionally invested because their tenant is basically a neighbor.

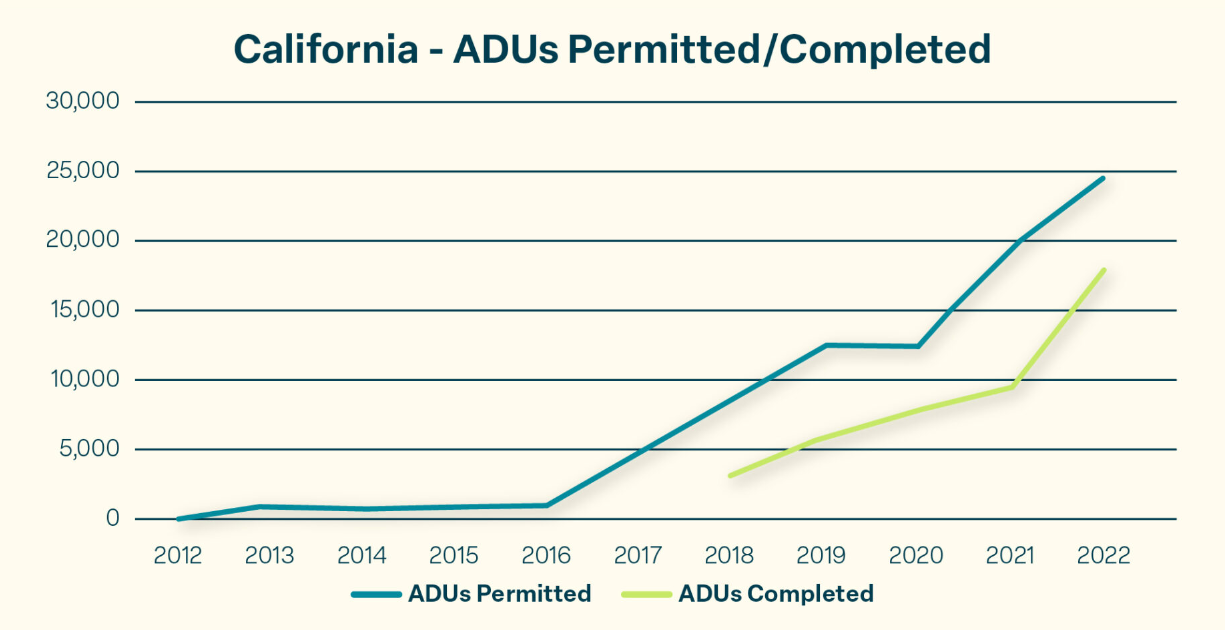

The opportunity: at 100 units charging $2,200/month rent with a 10% management fee, you're looking at $22,000/month in recurring revenue, plus $15-18K annually in placement fees. California alone permitted 26,924 ADUs in 2023—that's 2,244 new potential clients every month in one state. The cherry on top: home improvement loans (the primary financing path for ADUs) get denied at 35.4% versus just 12.9% for purchase loans. Appraisers can't properly value ADU income, which means there's a financing gap you can eventually own if you control the operations data.

The policy-demographics collision

California's 2017-2020 ADU reforms systematically eliminated barriers. Cities must approve or deny ADU permits within 60 days. No minimum lot sizes. No off-street parking requirements. No owner-occupancy mandates (as of 2021).

The results: ADU permits increased by 42-76% every year from 2016-2022, with only one exception (pandemic-disrupted 2020). From 2016 to 2023, California saw 20x growth in ADU permits. ADUs now represent 21% of all homes permitted statewide—roughly one in five new units. In Los Angeles, ADU permits surpassed single-family home permits in 2022: 7,160 ADUs versus 1,387 traditional homes.

California isn't alone. 18 states have passed ADU-enabling legislation. Washington legalized statewide ADUs in 2023. Oregon did it in 2018. Massachusetts passed MBTA Communities law in 2024, accelerating ADU development near transit.

Multigenerational living is the new default. 22% of adults 65+ now live in multigenerational households (up from 17% in 1990), and the NAR confirms that 17% of buyers are purchasing homes specifically to accommodate multiple generations. Millions of families can't afford two separate houses, but they can afford to convert a garage or build in the backyard.

Here's what matters: these forces aren't reversing. Locked-in mortgages, skyrocketing rents, and aging parents who need care mean homeowners keep staring at the same calculation: Can't move. Can't refinance. But I can turn the backyard into income.

Why "proximity landlords" need different infrastructure

Normal rentals don't have this dynamic. The landlord lives 20 feet away. Shared outdoor space, parking, and utilities matter. Noise and privacy boundaries trump granite countertops. Disputes can't be ignored—you see each other every day.

Traditional property managers are built for scattered portfolios across zip codes. They're not set up for "how do I keep my tenant happy when they share my driveway."

Your moat comes from standardized human outcomes: house rules that prevent blow-ups before they happen, onboarding scripts that set expectations around noise, parking, and guests, vendor networks with 48-hour maintenance response SLAs, and conflict mediation protocols that don't require lawyers.

Homeowners will pay for this because the alternative is managing a tenant-neighbor relationship with zero training and high emotional stakes.

What you're actually selling (in 4 layers, from GTM to the long game)

"We make your backyard unit behave like a professionally run rental."

Unlock the Vault.

Join founders who spot opportunities ahead of the crowd. Actionable insights. Zero fluff.

“Intelligent, bold, minus the pretense.”

“Like discovering the cheat codes of the startup world.”

“SH is off-Broadway for founders — weird, sharp, and ahead of the curve.”