A 25-year-old trend forecasting shop that lives inside furniture and design trade publications launched something last month that most of the tech world missed.

Future Snoops — formerly Fashion Snoops, the agency that's been guiding brands like LVMH, Under Armour, and Reebok through cultural shifts since 2000 — dropped MUSE, calling it a "creative intelligence engine." The pitch: take creators from research to activation in one unified workflow.

MUSE validated a category shift happening under the surface. Trend forecasting is evolving into an operating system. Knowing what's trending matters less than having the complete kit to ship it next week.

That gap between insight and execution kills small brands. Nobody's filling it.

The Real Bottleneck Isn't Seeing Trends

Every DTC founder has felt this: the trend was obvious, the timing was right, the product shipped eight weeks too late. The market already proved enterprise buyers will pay for AI trend prediction. Spate's consumer trend platform achieves 72% forecast accuracy and counts L'Oréal, Reckitt, and Boots as clients. Heuritech analyzes 3 million social media images daily with 90% accuracy predicting fashion trends 24 months out. Both companies sell pattern detection to big brands who can afford $50K+ annual contracts.

Trend detection is commoditizing fast. Multiple players now offer dashboards and reports across beauty, fashion, and consumer goods. Detection creates demand. It doesn't solve execution. DTC brands launching products monthly outperform quarterly launchers by 127% in revenue growth. Companies getting to market 6 months faster earn 33% more profit over five years than slower competitors.

The traditional launch timeline runs 6 to 8 weeks from concept to campaign. Consumer interest in trending topics peaks within 7 to 14 days before declining. By week 8, your "timely" product competes against trends that didn't exist when you started planning.

Traditional Timeline:

- Week 1-2: Spot the trend, research, validate

- Week 3-4: Develop concepts, source suppliers, negotiate samples

- Week 5-6: Create product descriptions, shoot content, brief creators

- Week 7-8: Finalize campaign, launch

- Result: You're launching as interest plateaus

Trend Ops Timeline:

- Day 1: Trend flagged, receive complete SKU pack

- Day 2-3: Review pack, request samples from suggested suppliers

- Week 2: Samples arrive, shoot quick content using provided hooks

- Week 3-4: Pre-orders live, validate demand

- Week 6-8: First batch arrives, seed to influencers from provided list

- Result: You're launching while the trend is still climbing

MUSE positioned itself as an "always-on partner" bridging research to activation. Trend intelligence as workspace demands automation next: show the trend, generate the launch plan, hand over the execution kit.

Enterprise Validated the Value. Microbrands Need the Speed.

Spate and Heuritech proved big brands will pay for early signals. What they don't provide is execution infrastructure. Their tools target enterprise strategy teams running quarterly planning cycles — not sub-5-person operators who need to ship next week.

Most trend tools still sell vibes: a report, a deck, a trend graph, a moodboard. Operators need a shippable pack. The wedge collapses this cycle — signal → product decision → sourcing → creative → launch — into something a tiny team can execute.

The Product: SKU Packs That Actually Ship

Each pack is a mini product team in a box. This mirrors how bigger brands already operate — trend platforms like Spate and Heuritech provide signals that product, merchandising, and marketing teams translate into line plans, packaging, and briefs. You're just compressing that entire workflow into a deliverable for teams of one to five.

Here's what it contains per micro-trend:

Trend Brief (1 page)

What it is, why it's emerging, who's buying (persona + demographics), shelf life classification (flash / seasonal / durable), and the kill-switch: what would end this trend?

Three SKU Concepts

Each concept includes product name + positioning (one sentence), differentiator, materials/feature suggestions, competitive set + price anchor.

Packaging + PDP Kit

Front-of-pack copy directions, Shopify-ready product description + bullets + FAQ, SEO title + meta description, shot list (UGC + clean product).

Creative Kit

5 TikTok hooks, 3 UGC scripts, angle map (aspiration, problem/solution, identity), static + short video ad concepts.

Supplier Starter Kit

Search terms for sourcing (Alibaba, 1688, local), RFQ template, minimum viable BOM checklist, 3 routes: cheap/fast, premium, local.

Influencer Seeding List (20 names)

Micro creators likely to bite, outreach angle + sample DM.

The supplier kit and seeding list differentiate this from content. They make it operational.

What This Looks Like in Practice

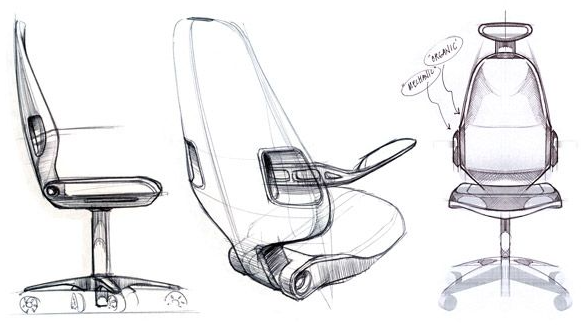

Example Pack: "Desk Jockey Wellness"

Say your trend graph flags rising interest in ergonomic accessories for WFH setups, but with a self-care angle. Search volume for "desk stretches" up 140% month-over-month, TikTok showing 2.3M posts tagged #deskwellness, Amazon keyword "posture reminder" climbing fast.

Here's what the pack delivers:

Unlock the Vault.

Join founders who spot opportunities ahead of the crowd. Actionable insights. Zero fluff.

“Intelligent, bold, minus the pretense.”

“Like discovering the cheat codes of the startup world.”

“SH is off-Broadway for founders — weird, sharp, and ahead of the curve.”