The pitch lands everywhere: "30% of fruit gets rejected for cosmetic reasons. We'll buy ugly citrus for pennies, extract vitamin C, sell a clean-beauty serum for $38, and call it circular."

Sounds like the perfect heist. Math works. Story breaks.

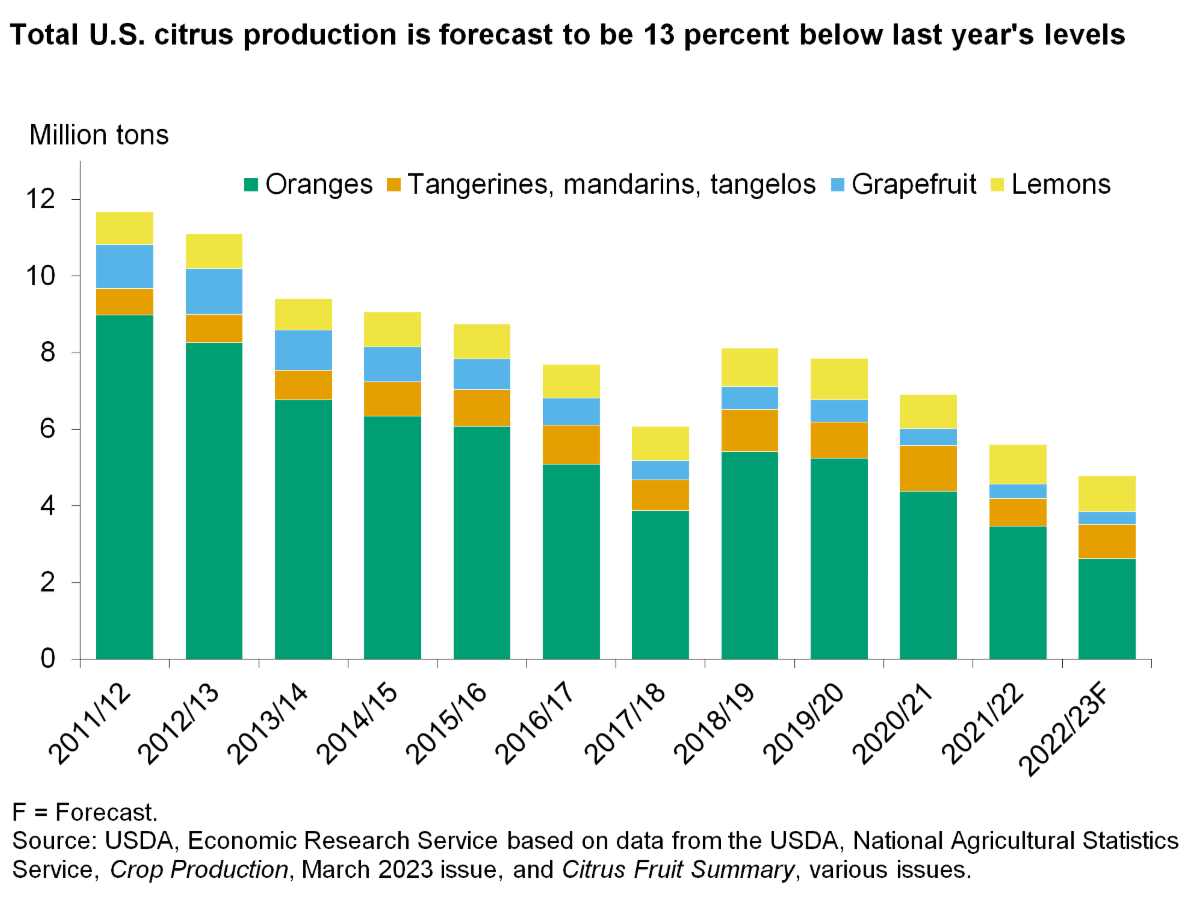

Florida just produced 14.52 million boxes of citrus in 2024-2025—the lowest output since 1919-1920, before commercial refrigeration existed. The state that once shipped 244 million boxes at its 1997-98 peak now manages barely 6% of that volume. California seized 84% of total U.S. citrus production in 2024-25, up from 79% just two years earlier. Florida's share collapsed to 13%. The "endless ugly oranges" narrative died with those numbers.

Citrus greening disease devastated groves. Three hurricanes in seven years destroyed infrastructure. Growers lost 64,000 acres in a single year. DeSoto County alone shed 18,910 acres—a 36.5% decline. Hillsborough County nearly vanished: 713 citrus acres dropped to 31, a 96% wipeout. Florida's getting $124.5 million in emergency state support for 2025-2026, with $100 million earmarked for disease-resistant trees and grove rehabilitation. That's triage funding, not expansion capital.

Building on "ugly fruit" means chasing a shrinking feedstock across collapsing acreage. The real arbitrage sits downstream: peels plus pulp from juice processors. Industrial waste streams, not blemished fruit.

Where the Waste Actually Lives

Cosmetic standards do cull fruit. Packinghouses track "packout" versus "eliminations"—what makes the fresh market cut and what gets diverted. A University of Florida/IFAS study shows navel oranges with 64% packout, meaning 36% gets sorted out and sent to processing plants at drastically lower prices.

Growers feel this financially. At 60% packout, the "eliminations" fetch much lower processed returns than fresh market prices. On a 1,000-box grove, that gap compounds fast.

The scalable, reliable feedstock isn't blemished fruit you chase farm-to-farm across shrinking acreage. It's what happens after fruit becomes juice.

Juice extraction creates 50-60% waste by weight. For every ton of oranges that becomes juice, processors dispose of 1,000-1,200 pounds of peel, pulp, and seeds. Globally, that's 10-14 million metric tons of citrus processing waste annually. Most gets sold as cheap animal feed or composted at a loss.

The waste stream includes peel (flavedo and albedo), pulp residue, seeds, and pomace. Peels account for 50-70% of total fruit mass and contain 50-60% lignocellulosic biomass (cellulose, hemicellulose, lignin) plus concentrated bioactives. Research shows citrus peels contain 0.67-19.62 grams of total phenolics per 100g dry weight, with hesperidin, naringin, and rutin as dominant compounds. These are the molecules that command premium pricing in pharmaceutical and cosmetic formulations.

California dominates production with 84% of U.S. citrus. Florida shrank to 13%. Texas and Arizona split the remaining 3%. California invests $15-18 million annually to keep citrus greening out of commercial groves. The waste streams have consistent moisture content, contamination profiles, and nutrient concentrations. A mid-sized California juice facility processes more citrus in a week than a "farm-to-brand" ugly fruit operation could source in six months.

If the plan is "Florida ugly oranges," it's built on a shrinking island. If the plan is "sign waste-stream contracts with juice processors across multiple states, then convert peel and pulp into cosmetic-grade actives"—that's infrastructure.

Certification as Moat

"Upcycled" isn't just marketing anymore. It's drifting toward procurement language.

Upcycled Certified launched for cosmetics in 2021 when the Upcycled Food Association extended its program beyond food into beauty, pet care, household cleaners, and dietary supplements. IFF's GENENCARE OSMS range—sourced from sugar beet molasses—became the first cosmetic ingredients to achieve Upcycled Certified status. That's the template: predictable tonnage, documented origin, repeatable quality.

The certification requires documented proof that ingredients come from verified waste streams. Supply chain documentation—bills of lading, invoices, waste records, production logs—must demonstrate food waste diversion with positive environmental impact. Where Food Comes From administers the program with annual audits and ongoing compliance reviews.

The minimum input thresholds: 95% upcycled content for "Upcycled Ingredient" designation, 10% for "Product Containing Upcycled Ingredients." Cost structure: approximately $175 per product in licensing fees, plus application and review fees that scale with facility count and product portfolio size.

The fees create a barrier. Most small brands can't or won't navigate this complexity.

The defensible advantage isn't "we make a vitamin C serum." Everyone can do that. The defensible advantage is:

- Exclusive or semi-exclusive waste contracts with processors

- Chain-of-custody paperwork plus audits that pass third-party review

- Standardized extracts with Certificates of Analysis specifying bioactive content

- Certification-ready operations so brands can make claims without reputational risk

You're not selling skincare. You're selling ingredient legitimacy.

DTC as Showroom, B2B as Bank

UpCircle Beauty saved 450+ tonnes of byproducts—primarily coffee grounds collected daily from 100+ London cafes, but expanding to argan shells, chai spices, fruit stones, and citrus ingredients. They landed in 800+ U.S. retailers and became the UK's #1 upcycled beauty brand by demonstrating repeatable sourcing and processing infrastructure.

Their insight: prove the concept with consumer products, but recognize that the highest-leverage play is B2B ingredient supply with DTC as proof, not the core engine. They transformed 55+ different waste ingredients into standardized cosmetic actives, showing formulators what's possible. The consumer line generates awareness and inbound interest. The real business happens when other brands want those ingredients.

The upcycled cosmetic ingredients market reached $254 million in 2024 and projects to hit $400-500 million by 2032. The broader upcycled beauty products market could reach $7.8 billion by 2033, growing at 15% annually. Capturing just 1-3% of the global upcycled ingredients segment represents $4-12 million in annual revenue at current projections. Cosmetic and botanical ingredient suppliers typically operate at gross margins in the 40-60% range—stronger when the feedstock is waste rather than cultivated botanicals.

Building the Upcycled Citrus Bioactives Platform

Forget "Ugly Fruit Theater." The bigger play is citrus upcycling infrastructure—owning the byproduct pipeline and selling standardized ingredients.

Start with 2-3 ingredient products buyers already understand:

Unlock the Vault.

Join founders who spot opportunities ahead of the crowd. Actionable insights. Zero fluff.

“Intelligent, bold, minus the pretense.”

“Like discovering the cheat codes of the startup world.”

“SH is off-Broadway for founders — weird, sharp, and ahead of the curve.”