In September 2025, MuleRun opened its agent marketplace. By December, they'd crossed 600,000 registered users with 160+ agents live and 50+ professional teams building on the platform.

Most users aren't building agents. They're buying them. Early creators who shipped agents in the first 90 days now control distribution most indie developers would kill for. Some are building toward $3,000-$6,000 monthly recurring revenue on worklines that took two weeks to ship. MuleRun is throwing Genesis Creator bonuses up to $10,000 and nearly 100% revenue share at people who can fill inventory gaps before their natural-language builder drops in early 2026.

After that, supply explodes. Market saturation doesn't flip overnight, but the promotional economics and empty shelf space disappear fast.

There's a real arbitrage play here. It's just not "build 50 random agents and pray."

What Happened With The App Store

When Apple launched the App Store in 2008, the first wave wasn't genius products. Flashlight apps, fart apps, utilities nobody remembers six months later. The second wave—the companies that actually made money—didn't chase novelty. They owned a job.

Everyone remembers when "there's an app for that" entered the lexicon. Nobody remembers most app names from 2008. Winners became infrastructure for specific tasks people did repeatedly.

The same pattern unfolds with AI agent marketplaces, compressed into an 18-month cycle instead of five years.

MuleRun's Creator Studio launched with full monetization, hosting, and distribution baked in. Creators upload agents built with workflow tools like n8n or Flowise, frameworks like LangGraph or Dify, visual builders like ComfyUI, or custom APIs. Set your pricing (per-run or per-minute), go live globally. The platform handles billing, model access (100+ AI models, all metered), and runtime operations with sub-3-second startup times.

The infrastructure is production-ready. The user base is growing fast. MuleRun actively recruits Genesis Creators with promotional incentives designed to fill the marketplace before the no-code wave hits.

The economics work today. SmartQ, an enterprise BI agent from Quick BI (a Gartner Magic Quadrant company), achieved 32% three-day retention on MuleRun. That's SaaS-grade stickiness for what amounts to a workflow automation tool.

The trap everyone's running into: treating agents like products.

Why "50 Random Agents" Is How You Lose

Look at MuleRun's marketplace today. You'll see the same pattern that killed early App Store developers: commoditization.

Agents for "PDF to CSV," "Twitter thread to LinkedIn post," "summarize meeting notes," and every other obvious utility you can think of. These get cloned, underpriced, and outranked the moment the natural-language builder launches. You're competing on prompt engineering, which is the least defensible moat in history.

Creators making money aren't selling agents. They're selling work.

The AI agent market is projected to grow from $7.63 billion in 2025 to $182.97 billion by 2033—a 49.6% CAGR. North America dominates with 39.6% market share. The no-code AI platform market will hit $44.15 billion by 2033, up from $4.28 billion in 2024.

Those numbers represent a massive wealth transfer from manual labor to automated workflows. The money doesn't go to whoever builds the cleverest prompt. It goes to whoever owns the workline.

The Workline Framework

A workline is a repeated, measurable workflow inside a department that you can decompose into agents and own end-to-end.

Not a feature. Not a tool. The entire job-to-be-done, packaged as a system. You're building "labor in a box" for one painful function. Think of it as a factory in the digital age, your customer only has to buy the finished product while you manage the start-to-finish. Workline is where the money is in the AI agent landscape. Leave the rest to others—those are just fad/noise.

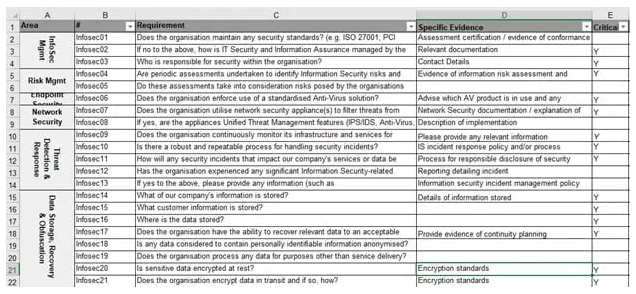

Take vendor security questionnaires. Companies doing SOC 2 compliance send and receive hundreds per year. Each one is 100-200 questions spanning access controls, encryption policies, incident response procedures, and evidence documentation.

Right now, this workflow looks like:

- Receive questionnaire (Excel, PDF, vendor portal, or custom format)

- Internal team member manually reads each question

- Someone from IT, legal, or security answers based on internal policies

- Responses get reviewed for accuracy and tone

- Evidence gets attached (SOC 2 reports, pen-test summaries, policy docs)

- Final document returned to vendor

This takes 4-8 hours per questionnaire. Companies handling 20+ questionnaires per month spend 80-160 hours on this alone. At $75/hour loaded cost, that's $6,000-$12,000 monthly just in labor. They will happily pay you $1,500-$5,000/month to manage the entire process.

Unlock the Vault.

Join founders who spot opportunities ahead of the crowd. Actionable insights. Zero fluff.

“Intelligent, bold, minus the pretense.”

“Like discovering the cheat codes of the startup world.”

“SH is off-Broadway for founders — weird, sharp, and ahead of the curve.”