In 2010, Japanese researcher Atsushi Tero pitted a brainless organism against the smartest urban planners in history.

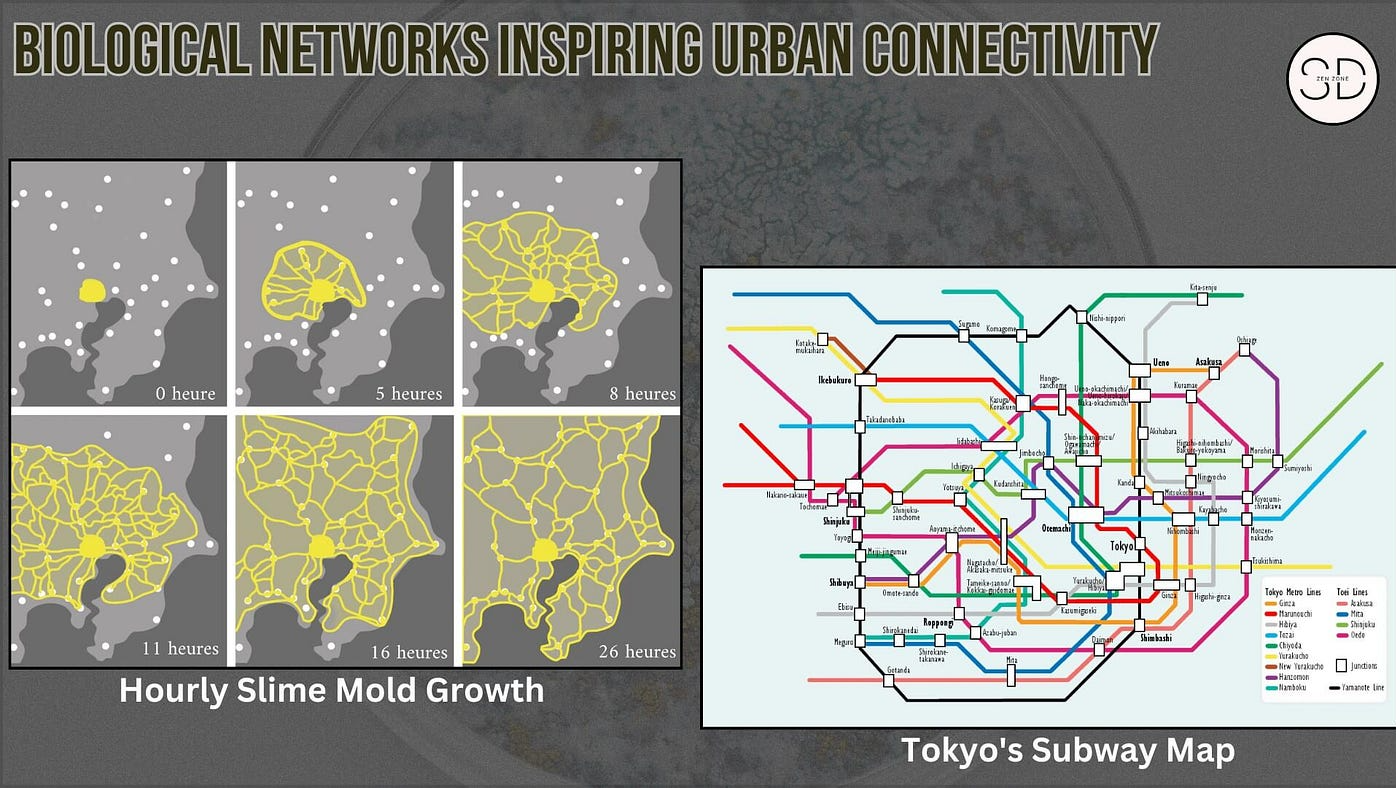

He arranged oat flakes on a surface in the exact geographic pattern of the cities surrounding Tokyo. Then, he released a yellow slime mold—Physarum polycephalum—into the center. The mold has no brain and no central nervous system. It simply has a biological imperative: find resources efficiently.

The mold sent out exploratory tendrils. Dead-end paths retracted. Successful routes to food thickened to maximize flow. Within 26 hours, the organism had recreated the Tokyo subway system—with one crucial difference. The mold's network was mathematically more efficient and resilient than the rail lines human engineers spent decades and billions of dollars designing.

The lesson: we tend to believe that intelligence flows from the top down, from the architect to the builder. But nature keeps proving that the most accurate data comes from the bottom up.

A central planner in a boardroom is guessing.

A hungry swarm on the ground knows.

The $300 billion fast-food industry is dealing with this exact problem right now.

Brands like McDonald's and Taco Bell act as the central planners. They spend $200,000 launching limited-time drops—the McRib, the Quesarito, the pickle-flavored Oreo—but they're flying blind. They don't know where the product actually landed, or how fast it's disappearing from independent franchises. They need better ground intelligence. They need their own slime mold.

Today's opportunity is to build the Snack Drop Hunter—the "Waze for limited snacks" that turns hungry fans into a verified sensor network. By gamifying the hunt for consumers, you capture the real-time data that brands are desperate for.

The model is two-sided and lucrative: you charge superfans $5/month for early alerts, then sell the "demand intelligence" back to the brands for up to $8,000/month. It's a low-code build with a clear path to $1.5M ARR, just by organizing the swarm.

Read the full playbook here:

QSRs run $200K limited drops with no real-time visibility. Build the verified hunt map that becomes their demand oracle.

From the Vault:

Nearly 20% of Gen Z uses joint supplements. The category hit $14B and projects to $27B. No brand positions mobility like skincare yet.

Campbell paid $2.7B for Rao's restaurant sauce. Independent restaurants can't navigate FDA compliance to capture the same $368B opportunity.