How to turn "shop local" from a bumper sticker into a buying habit worth building a business around.

On some block in your city sits the shop you assume will be there forever. The bookstore with crooked shelves. The ceramics studio surviving on vibes. The apparel spot where everything costs 20% more than Amazon—and you buy the hat anyway, because you want to be the person who buys the hat.

Then one day, a "Now Leasing" sign goes up.

Another storefront lost to a national chain with perfect lighting and zero soul.

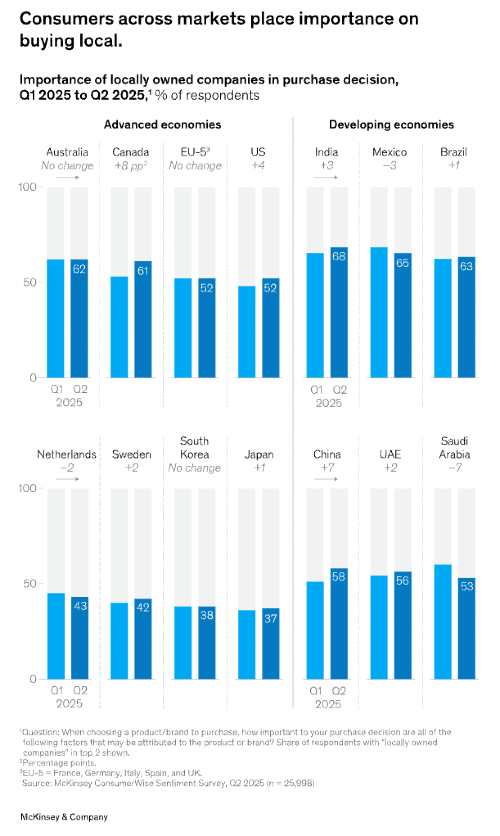

Main Street collapsed because there was no infrastructure to support consumer intent. People like local. They just lack a low-friction, high-trust path to find local goods online without wading through Etsy noise, Instagram roulette, or eight separate Shopify sites. McKinsey's 2025 State of the Consumer report found 47% of consumers globally say locally owned companies matter to their purchase decisions, with the preference strongest in Canada and the United States. Capital One Shopping estimates Americans spent $3.74 trillion at local stores in 2024. Faire's research suggests Americans would spend an additional $150 per month to support neighborhood shops if they could find them easily.

The appetite is massive. The buying ritual? Nonexistent. And that missing ritual represents a path to $100K+ MRR before you even license the model to other cities.

Stop Building Marketplaces. Build Buying Behaviors.

Marketplaces offer infinite products and let algorithms sort the mess. Buying behaviors tell you what to get this week—and why you'll be proud you got it first.

The wedge that works borrows from streetwear culture: limited drops, hard curation, status mechanics, and proof.

Think of it as a Local Indie Drops Club:

- Time-boxed drops (weekly) in one metro

- Hard curation (10–30 makers max per month)

- Story as product (every item ships with a maker story card and page)

- Verification as feature (anti-reseller, proof-of-origin, lightweight audits)

- Convenient fulfillment (pickup points + scheduled route delivery)

- Membership layer (early access, perks, badges, events)

Call it "Hypebeast meets Small Business Saturday"—built as a repeatable format rather than a feel-good one-off.

The Drop Model Explained: How Supreme Actually Works

Before you build this, you need to understand the mechanics behind drops—the psychology, not just the vibes.

Supreme didn't invent the drop model. They perfected it. The tactic came from elite streetwear labels in Japan, which would "drop" only one or two of each highly-coveted shirt at a time. Supreme industrialized the psychology.

The Ritual. Every Thursday at 11 AM, Supreme releases new items online and in-store. Customers who want a piece from the new collection must be ready at exactly that moment. The company bans overnight camping—the line forms at dawn. By 10:30 AM, three blocks in downtown Manhattan are dotted with security guards monitoring an ever-growing line of teenagers, college kids, and weathered twenty-somethings waiting to buy sweatshirts, t-shirts, and puffer jackets.

The Illusion of Scarcity. Supreme's apparel is mass-produced. Fans on Reddit estimate the company produces at least 10,000 units of each product per drop. But Supreme keeps supply slightly below demand—and targets drops geographically to limited stores and online. The result is that every drop creates the perception of extreme scarcity, giving products the appeal of luxury goods at a fraction of the price. Website traffic can spike by 16,800% at drop time. Most items sell out in under a minute.

The Psychology. Behavioral economist Robert Cialdini identified scarcity as one of the most powerful persuasion principles. We hate losses more than we love equivalent gains. When Supreme drops a new hoodie, not buying it feels like a loss of opportunity—even if you didn't want it that much in the first place. Layer in social signaling (these items become status symbols) and the fear of missing out (60% of consumers have made purchases driven by FOMO within 24 hours, according to recent surveys), and you have a formula that converts casual interest into frantic action.

The Flywheel. Supreme rarely sends emails. They don't advertise. Fans rely on Twitter accounts like @dropssupreme and blogs like Highsnobiety for community intel about upcoming releases. The scarcity creates a massive resale market—a Supreme brick (yes, a literal brick with their logo) has sold on eBay for up to $10,000. The secondary market generates free marketing, which drives primary demand, which justifies more scarcity.

Supreme sells the experience of acquisition. The line, the drop time, the sold-out moment—these are features.

The Last Crumb Proof Point: Drops Work for Cookies

You might be thinking: sure, this works for streetwear with brand cachet. Can you really apply Supreme's model to cookies?

Last Crumb launched in 2020 with a radical premise: what if you sold cookies the way Supreme sells hoodies? Their "Michelin-star quality" cookies are handmade in Los Angeles over a three-day process using proprietary techniques, French chocolate cut into bite-sized pieces, and homemade butter mixtures. A dozen cookies costs $150.

The kicker: you can't just buy them. You join a waitlist. Each week, Last Crumb runs a drop. Within the first 16 weeks, they amassed 80,000 people on their waitlist. Each drop sold out in seconds. After one year, the waitlist exceeded 200,000 customers, drops were selling out in less than 30 seconds, and the company was generating eight figures in annual sales—with a $0 marketing budget.

Scarcity was structural. They positioned the cookies as luxury items, not impulse snacks. Each cookie is individually wrapped in matte-coated bags with a unique serial number reflecting its batch. The packaging experience rivals a Tom Ford unboxing. When the box arrives, customers immediately share it on Instagram and TikTok—generating organic buzz that feeds the next drop's waitlist.

The experience was the product. Co-founder Alana Arnold explains: "I was drawn to the 'drop' mentality for sneakers and merch, and people's dedication to getting something they can't have fascinated me. It made me realize it's not just about the product. It's about the experience, the community, and overall brand affinity."

The positioning eliminated competition. As CEO Matthew Jung puts it: "Derek told me he wanted to build the 'Rolex of cookies.' It was crazy, but that's what made it so intoxicating." Last Crumb doesn't compete with grocery store cookies or even local bakeries. They compete with luxury gifts—wine and cheese baskets, high-end chocolate, designer accessories.

Drops don't require global brand recognition. They require scarcity, story, and an experience worth talking about.

A ceramics studio in your city could run a monthly kiln drop—12 pieces from their latest firing, available to members first, gone in hours. A specialty bakery could do a "Friday Four"—four limited items announced Wednesday, sold Friday, never repeated. A leather goods maker could release one new design per month with a 48-hour window and 50-unit cap.

The format is portable. The ritual is what matters.

Local Consumers Already Behave This Way

CSA farms prove weekly ritual commerce works. Community Supported Agriculture has operated on a drop-style model for decades: subscribe in spring, pick up a weekly box of seasonal produce throughout the season. The U.S. now has over 12,500 CSA farms. The model works because it combines ritual (weekly pickup), community (fellow members at the pickup site), story (relationship with the farmer), and commitment (upfront payment creates buy-in). Customers pay $200–$500 per season and show up religiously.

Cities like Portland, Asheville, and Lancaster have run successful "shop local" campaigns with community card programs, generating tens of thousands of dollars in local gift card sales and 80%+ redemption rates. These programs prove that when you give consumers a system—not just a sentiment—they use it.

You won't have teenagers camping overnight for handmade pottery. But you can have email lists of 5,000 locals who open every Thursday "drop alert" at 9 AM, knowing that the best pieces will sell out by lunch. You can have pickup points at the local coffee shop where customers bump into each other and ask "did you get the new mugs?" You can have members bragging on neighborhood Facebook groups about their Founding Member status.

The hype is quieter. The behavior—anticipation, urgency, identity, community—runs on identical mechanics.

Why Now: The Timing Wedge

Local preference is rising—and becoming identity. McKinsey's consumer research shows this isn't pandemic nostalgia. Tariff volatility, supply chain anxiety, and cultural backlash against faceless globalization are making "local" a signal of values. In China, six of the top ten beauty brands gaining share since 2020 are domestic. In Japan, nine of the top ten snack brands are Japanese. American consumers are following.

Brand fatigue is real—and trust is collapsing. Consumers are drowning in choice and skeptical of advertising. Research indicates 74% of customers walk away from online purchases due to sheer volume of options. Meanwhile, Etsy's perceived counterfeit and reseller problems have eroded trust—Reuters reported Citron allegations about counterfeit goods, and industry publications have documented seller backlash about mass-produced items undermining the platform's handmade ethos.

The window is open for whoever solves this: curated, verified, local, with a ritual attached.

The Competitive Reality Check

You're competing with habits, not "big brands."

Etsy remains enormous—Marketplace Pulse estimates $12.72 billion in GMS for 2024, and despite headwinds, the company reported roughly $2.7 billion consolidated GMS in Q3 2025. Faire, the B2B wholesale marketplace connecting independent retailers with brands, just hit a $5.2 billion valuation in late 2025, expecting nearly $3 billion in GMV this year with 800,000+ retailers on the platform.

These players win on scale and infinite catalog. A "local Etsy clone" gets crushed.

Your advantage is the opposite:

| Etsy / Big Marketplaces | Local Indie Drops Club |

|---|---|

| Infinite selection | Finite, curated picks |

| Algorithmic discovery | Human taste, editorial POV |

| Global shipping, delays | Local density, speed |

| Anonymous sellers | Verified, story-first makers |

| Passive browsing | Weekly ritual, time-boxed |

You're building a buying habit, not a better marketplace.

The Wedge That Works: Drops + Proof + Logistics

Unlock the Vault.

Join founders who spot opportunities ahead of the crowd. Actionable insights. Zero fluff.

“Intelligent, bold, minus the pretense.”

“Like discovering the cheat codes of the startup world.”

“SH is off-Broadway for founders — weird, sharp, and ahead of the curve.”