QVC didn't win because it had the best blender.

It won because it had the best moment.

The camera zooms in. The host pours something thick and disgusting into a glass. The blender roars. The liquid turns silky. The ice becomes powder. The host smiles like they just discovered fire. And before your brain can ask "Do I need this?", your hand has already reached for your wallet.

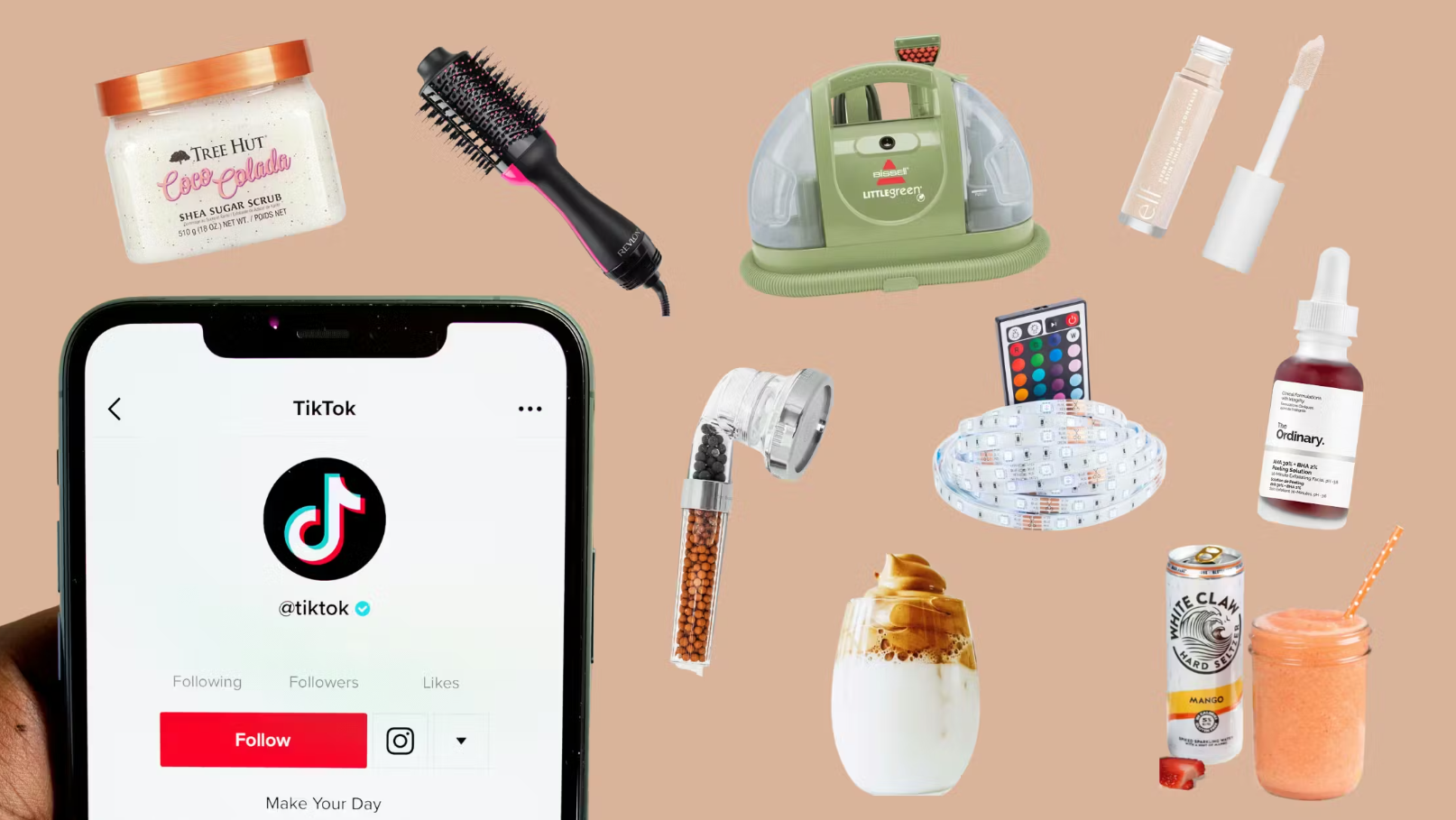

TikTok Shop operates on the same mechanic—except the host is a 19-year-old in a bedroom, the "moment" is five seconds long, and the checkout is already sitting under the video. U.S. sellers hit $9 billion in GMV in 2024, up 650% year-over-year. The platform added 11.9 million new U.S. buyers last year. EMARKETER pegs U.S. sales hitting $15.82 billion in 2025. Global GMV crossed $33.2 billion in 2024, more than doubling year-over-year, with TikTok reporting $500+ million in U.S. sales during just the four-day Black Friday–Cyber Monday window in 2025.

The price point that makes brains stop thinking sits in the "why not" band: $10–$30, where a visually dramatic SKU can pop off from a single clip and turn into a mini-stampede.

@vanillacrush 🤮 Stop drinking added sugar and get yourself a juicer blender 👏🏻 Freah juice detox! #tiktokshop #cleantok #juicer #orangejuice #juicerforbeginner #juicermachinereviews

♬ Beautiful piano but scary atmosphere horror style - MoppySound

There's money in "find a viral $15 thing and ride it." But the actual heist is building a Visual Virality Product Lab—a rolling microbrand studio that systematically hunts for filmable proof moments, tests them fast, scales winners, kills losers, and compounds learnings into a dataset plus creator rail that other sellers can't copy. Run this for six months, you've got enough data to spin up a subscription intel product at $79-$249/month selling ranked opportunities to sellers who don't want to burn cash learning. Run it for a year, you've got a creator bench and launch infrastructure worth licensing.

This only works if you treat it as an operationally intense, experiment-driven studio—not a "viral product" side hustle.

The Heist (In One Sentence)

Build a factory that turns 5-second visual payoffs into repeatable sales—then sell the factory to everyone chasing the same gold rush.

This starts as a portfolio of micro-products. It graduates into an "intel plus distribution" layer for TikTok commerce.

Why the $10–$30 Band Prints

A $19.99 purchase is a dumb buy. A $199 purchase is a dumb identity. TikTok excels at the first.

During Black Friday 2024, TikTok's average order value hit $59.60—significantly lower than Meta's $100.17 and Google's $88.17. The entire feed is engineered for "why not?" purchases where the downside is forgettable. FindNiche data shows the majority of top-selling TikTok Shop items fall between $10 and $30. Low price equals low hesitation equals fast checkout. The algorithm amplifies emotional, impulsive reactions. Creators can drive volume through simple demos without polished production.

Example: In Q1 2025, a $15 LED galaxy projector became a breakout hit. Sellers partnered with small creators who filmed "bedroom glow-up" videos. A single viral clip drove over 10,000 orders in two weeks. No ad budget. No influencer contracts. Just a five-second visual payoff that made thumbs stop mid-scroll.

TikTok sells physics, not persuasion. The products that win demo themselves: glow-up lighting, peel-off transformations, foam/slime/ASMR texture reveals, before/after cleaning, snap-on "I fixed it" gadgets, hair tools that visibly change the silhouette.

That $15 galaxy projector works because the proof-moment is instant. A bedroom transforms from boring to ambient in three seconds. The viewer doesn't need convincing—they already saw it work.

TikTok fundamentally changed its ad infrastructure in July 2025. GMV Max became mandatory for all Shop sellers. Manual targeting? Gone. Granular audience controls? Gone. Placement selection? Gone.

GMV Max is TikTok's automated commerce system. You set a budget and ROI target. The algorithm handles everything else—creative selection, audience targeting, bidding, placements. It pulls from organic posts, affiliate videos, and Spark Ads to build campaigns automatically.

Advertisers lost the ability to fine-tune. Some ad buyers have complained about losing visibility and control, with Business Insider reporting concerns about the shift feeling "premature" for larger brands. But sellers gained something else: the platform now optimizes for total channel ROI across organic, paid, and affiliate traffic simultaneously.

The trade-off: you're operating inside a black box. You won't always see granular attribution by creative or audience segment. The system decides what works. Your job is to feed it options.

Your edge is no longer better targeting. Your edge is more proof-moments per week than the other guy.

Brands generating $1 million monthly on TikTok Shop typically produce over 1,000 videos per month. TikTok's internal data shows a near-straight-line correlation between video volume and GMV. The system needs content to test, scale, and rotate. Without it, GMV Max has nothing to work with.

The Trap (And Why Most People Lose)

Playing this as "random SKU roulette" gets you refund spikes from products that don't match the video, supplier chaos when you can't reorder fast enough, shipping delays that kill momentum mid-campaign, saturated products where margins collapse overnight, and a treadmill where every win expires in 14 days.

You need a system that compounds. And you need to accept that this is an operations business disguised as a creative business. Most "labs" die from supply chain sloppiness and refund hell, not lack of ideas.

The Real Moat: Proof-Moment IP

Forget "product research" as your moat. That's table stakes. Generic SKU lists will be everywhere once this meta-play gets popular.

Your moat is a proprietary map of which hook types convert in which categories, what price points maximize conversion without refund hell, which creator archetypes can reproduce the proof-moment reliably, what combinations drive UGC density (how many organic videos appear per 1,000 orders), and which SKUs scale without collapsing under quality and fulfillment constraints.

This is the dataset top TikTok-native brands build internally but never sell. You're building it to operate and to monetize as a product.

The 3-Asset Stack

Unlock the Vault.

Join founders who spot opportunities ahead of the crowd. Actionable insights. Zero fluff.

“Intelligent, bold, minus the pretense.”

“Like discovering the cheat codes of the startup world.”

“SH is off-Broadway for founders — weird, sharp, and ahead of the curve.”