Nebula generates $516K monthly in U.S. revenue alone. CHANI pulls $405K. Co-Star serves 30 million users globally and converts enough to sustain a $214K monthly U.S. run rate. Together, astrology apps form a $3-4 billion market projected to hit $9 billion by 2030.

Here's the opportunity they're missing: focus on a non-obvious but lucrative niche. 200 founders at $19/mo is $45K ARR. Add three $2K "Launch Timing Sprint" clients monthly and you're at $117K ARR in year one. Scale to 1,000 paid users and you're looking at $228K ARR before you touch team plans or premium tiers. The wedge is tighter than astrology's mass market, but the willingness to pay is 3x higher.

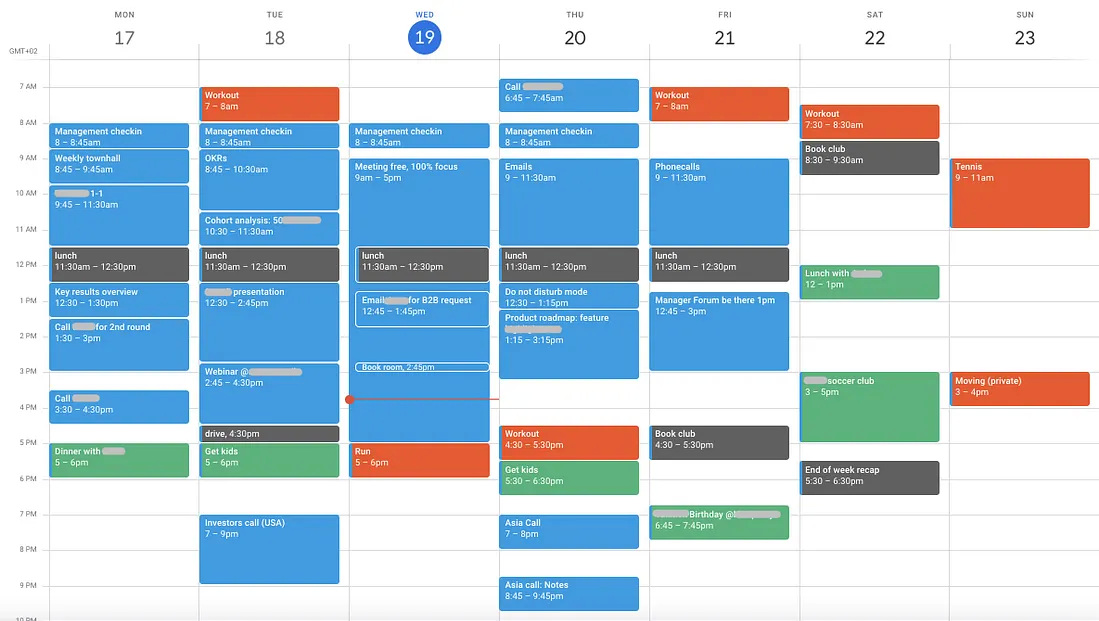

Strip away the zodiac and you're left with something founders desperately need: a calendar layer that answers "When should I do this thing that matters?"

Motion raised $60M building an AI calendar that auto-schedules tasks. Clockwise optimizes meeting logistics for teams. Both treat all founder hours as equal. Neither accounts for the fact that your 10 AM brain and your 3 PM brain are functionally different organs.

The wedge nobody's claimed: temporal decision hygiene for founders. Same-day value, long-term moat.

You make 47 decisions before 10 AM. Email triage. Slack responses. Investor intro — yes or no? Feature prioritization. Hire that PM. Push the launch. Kill the partnership. Stack the all-hands on Tuesday or Wednesday.

Each one chips away at what psychologist Roy Baumeister calls your "ego depletion reserve" — the mental battery that determines whether your 4 PM decision is as sharp as your 9 AM one. Rand Fishkin documented this breaking point in Lost and Founder: after making hourly calls as CEO, he reached cognitive exhaustion where he defaulted to consensus and safe choices, decisions that ultimately hindered Moz's growth trajectory.

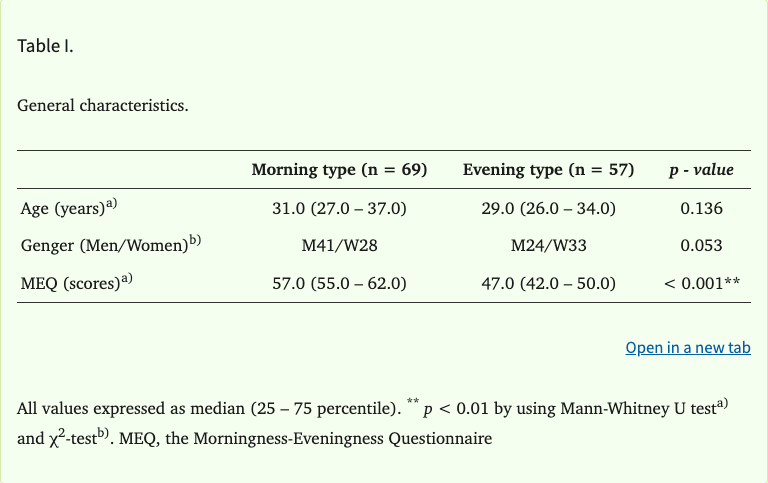

Research from the Journal of Biological Rhythms shows your chronotype — whether you peak at 10 AM or 10 PM — creates measurable differences in hormone levels, body temperature, and gene expression that swing decision quality by 20-30%. Morning types crush analytical work before noon. Evening types ("Wolves" in chronobiology) hit their stride after 2 PM and experience a second wind around 9 PM.

Most founders ignore this and schedule their pitch deck review for 3 PM on Friday.

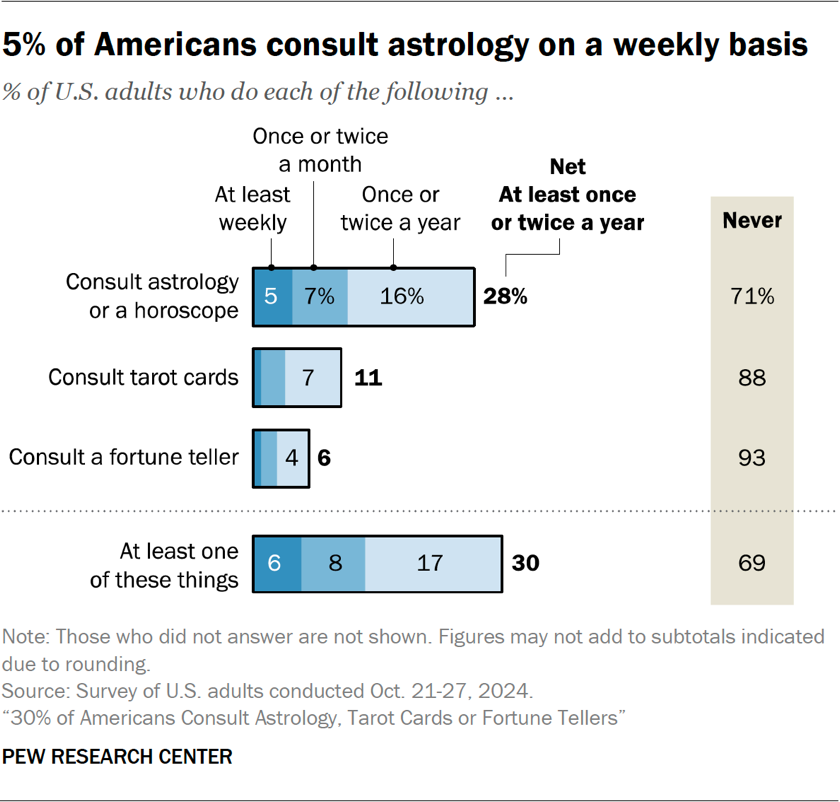

The market exists — it's just serving the wrong customer

The appetite for timing frameworks is validated at scale. U.S. smartphone users include 80% of Gen Z and younger millennials who report believing in astrology. The psychic services industry generated $2.3 billion in 2024.

When pressed, users don't cite divine insight. They describe astrology as "helpful frameworks" for personal and professional decisions. People want structure that reduces regret and increases perceived agency in high-uncertainty environments.

Co-Star integrated ChatGPT in 2023. CHANI blends horoscopes with wellness content. The Pattern follows similar mechanics. All three monetize through freemium models with 15-30% conversion rates at $10-15 monthly subscriptions.

The category proves demand exists. The opportunity is redirecting that demand toward founders who need timing frameworks but won't download a zodiac app.

What founders actually need

Daniel Pink's research in When: The Scientific Secrets of Perfect Timing confirms time of day explains 20% of performance variance. He identifies three daily stages for most people: Peak (high vigilance, analytical capability), Trough (lowest mood, highest error rate), and Recovery (enhanced mood, creative capability). The order reverses for evening chronotypes.

A 2025 study in Occupational Health Science found evening chronotypes show significantly higher odds of poor work ability and marked productivity loss when forced into standard 9-5 schedules. Morning types demonstrate the lowest risk of these outcomes.

Translation: your "lark" founder should stack investor meetings from 9-11 AM. Your "wolf" founder should protect that window for deep work and pitch after 2 PM.

Motion schedules tasks based on deadlines and calendar gaps. Clockwise creates "focus time" blocks. Both optimize logistics. Neither treats "when you do your best pitching" as a first-class product question.

That gap is the wedge.

Core promise: "We tell you when to pitch, when to ship, and when to disappear."

The product: day-1 value, quarter-1 moat

Inputs (Week 1):

Unlock the Vault.

Join founders who spot opportunities ahead of the crowd. Actionable insights. Zero fluff.

“Intelligent, bold, minus the pretense.”

“Like discovering the cheat codes of the startup world.”

“SH is off-Broadway for founders — weird, sharp, and ahead of the curve.”