Two hours after midnight, Salvador Dalí did something that sounds like a Silicon Valley productivity hack but was really a jailbreak. He'd sit in a chair holding a heavy key over a metal plate. As he drifted into hypnagogia—that strange threshold between waking and sleep—his muscles would relax, the key would fall, and the crash would wake him. Then he'd capture whatever images his brain had started generating.

Dalí didn't call it "optimizing sleep." He figured out a loophole: creativity spikes in the doorway between awake and asleep.

MIT and Harvard researchers have built devices to do a cleaner version of that same trick. They inject audio prompts at sleep onset to steer what people dream about. The technical term is Targeted Dream Incubation. Spending just 15 seconds in N1 sleep (that first drowsy stage) triples the chance of creative insight compared to staying awake. Dream about a specific theme during that window and creative performance jumps 43% on tasks related to that theme.

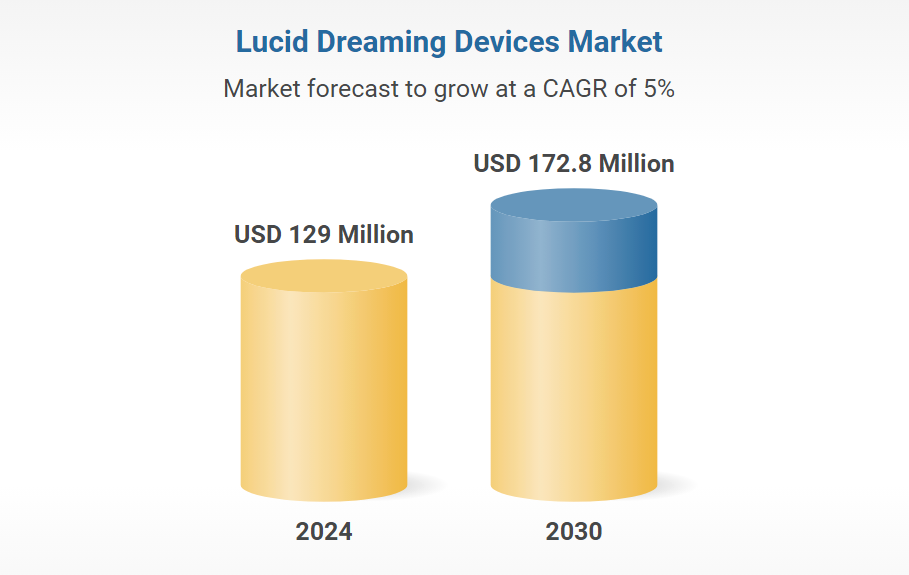

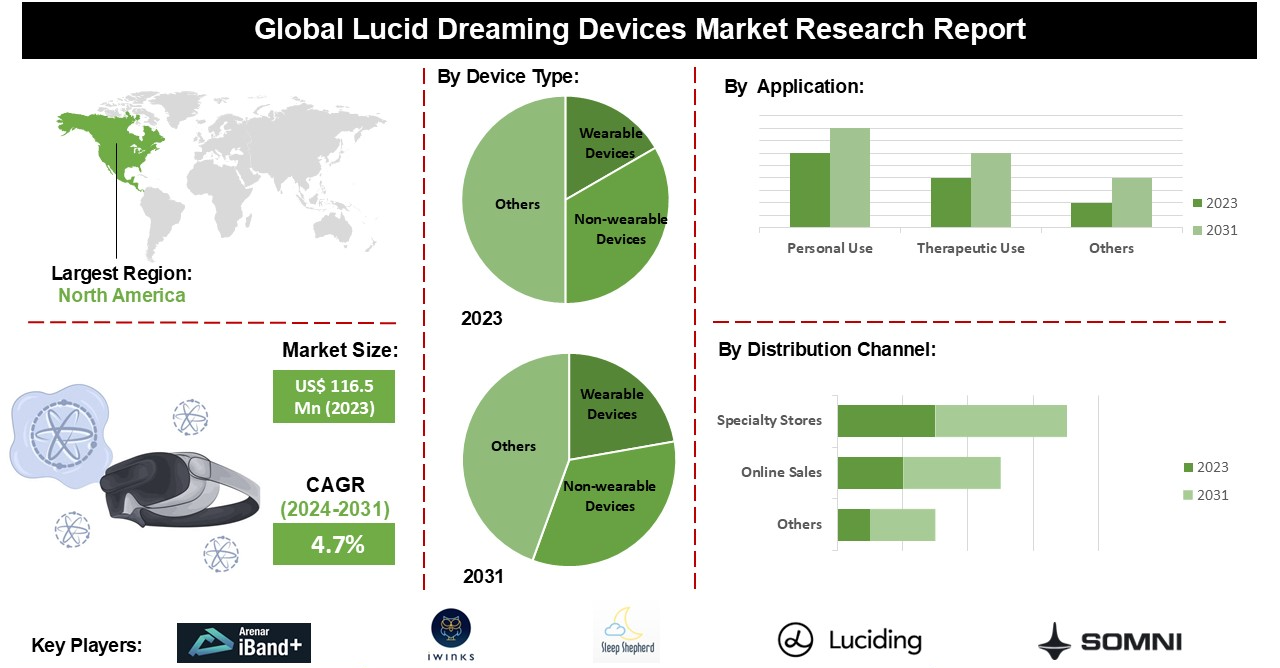

The market already exists. Lucid dreaming devices pulled $116 million in 2024, projected to hit $190 million by 2034. Twitch sleep streams logged over 2 million hours watched in a single month back in 2021, with streamers like Amouranth claiming $15,000 per sleep stream. Sleep-streaming isn't a curiosity anymore—it's normalized culture.

Sleep streams monetized being unconscious. Dream incubation monetizes what your mind does while you're unconscious. Package it right and you're looking at $9-15 monthly subscriptions for the core product, $19-49 creator-led "Dream Runs," and enterprise deals for creative teams that need overnight problem-solving sessions.

The Opening

The wedge is already forming. Lucid dream coaching exists as paid cohorts and guided audio tracks. Reality check apps have audiences. The lucid dreaming device market hit $129 million in 2024 and analysts project $173 million by 2034.

But you're not just selling to lucid dreamers. Your real TAM is the intersection of sleep wellness, productivity tools, and the creator economy—think meditation apps, ASMR channels, and parasocial creator relationships. People already pay for premium experiences and fall asleep to creator content. They just don't have a structured format that delivers measurable overnight cognition.

Selling coaching or sleep masks misses the bigger play: a Dream Incubation Audio Lab that grows into a nighttime operating system—programmable dreams, measured outcomes, creator monetization, and a data moat.

The viral hook writes itself: "I dreamt about X because of this app." That's a screenshotable story people want to share.

What's Real

You can bias dream content with audio cues

Targeted Dream Incubation is legitimate research from MIT's Media Lab. Play specific prompts at sleep onset and dream reports shift toward those themes. Not guaranteed control, but meaningful steering.

The Dormio device—developed by Adam Haar Horowitz and team—demonstrated this across multiple studies. Participants prompted to dream about "trees" during hypnagogia incorporated tree content into 67% of their dreams, compared to 0% in control groups. Post-sleep, they performed 43% better on creativity tasks involving trees.

Consumer reality check: Lab effects are robust but measured in controlled settings with specific protocols and short naps. Consumer sleep is messier—noisier devices, irregular schedules, deeper initial sleep stages for some users. Effect sizes in the wild will be smaller and more variable. That's fine. You're not selling guaranteed dream control. You're selling subjective creative and emotional outcomes, and even partial theme incorporation creates shareable moments.

The sleep-onset zone is a creativity lever

Solid evidence shows N1 (that first light-sleep stage) is a creative sweet spot. A 2021 Science Advances study found that spending just 15 seconds in N1 tripled the chance of solving a hidden mathematical rule (83% vs 30% for those who stayed awake). Go past N1 into deeper sleep and the effect vanishes.

The mechanism makes sense: N1 loosens cognitive control enough to explore distant semantic associations while preserving enough awareness to capture the insights.

The market is already paying

The lucid dreaming device market sits at $116 million (2024) with projected growth to $190 million by 2034. Multiple market research firms confirm the segment exists and is growing at 5-8% CAGR.

Apps like Awoken, Oniri, and Dream Journal have established audiences. Hardware like NovaDreamer, Sleep Shepherd, and iBand+ have sold hundreds of thousands of units. The behavior exists—the packaging is clunky.

Sleep content is normalized culture

Sleep-streaming went from "weird" to "of course it exists" on Twitch. The "I'm Only Sleeping" category grew from under a million hours watched in 2020 to tens of millions by 2022, with triple-digit growth and ongoing records. Ludwig Ahgren's 31-day subathon included hours of sleep content. Some creators have generated millions of hours watched solely from sleep segments.

Major press outlets (WIRED, Sociological Review, GeekWire) have covered sleep streaming as an established phenomenon. The New York Times and Guardian have run features on lucid dreaming research.

The behavior is here. The product packaging is not.

Where the Market is Weak

The existing ecosystem has three fatal gaps:

Fragmented tools. Dream journals live in one app. Audio tracks scatter across Spotify and YouTube. Sleep tracking happens in Apple Health or Oura. Nothing connects.

Too much mysticism, not enough mechanism. Most lucid dreaming content leans heavily into spiritual framing. That works for true believers but alienates the pragmatist who just wants to solve a work problem or process a breakup.

No standardized format. Every creator reinvents the wheel. There's no "Dream Script" spec, no protocol for timing cues, no shared language for what makes an effective incubation program.

The contrarian insight: don't sell sleep, sell overnight cognition.

Headspace and Calm sell relaxation and hygiene. Dream incubation sells outputs: creative sparks, emotional reframes, rehearsal, narrative immersion. That's how you avoid becoming "another ambient audio app."

The Product

Dream Script Standard

Turn "random bedtime MP3s" into a structured spec:

Unlock the Vault.

Join founders who spot opportunities ahead of the crowd. Actionable insights. Zero fluff.

“Intelligent, bold, minus the pretense.”

“Like discovering the cheat codes of the startup world.”

“SH is off-Broadway for founders — weird, sharp, and ahead of the curve.”