Your new sales rep just hit month three. They're still fumbling through Salesforce. Still asking what the JIRA fields mean. Still shadow-watching teammates who actually know the workflows.

That's costing you roughly $50K in lost productivity per rep. Multiply that by 15 new hires per quarter and you're hemorrhaging three-quarters of a million dollars annually on ramp time alone.

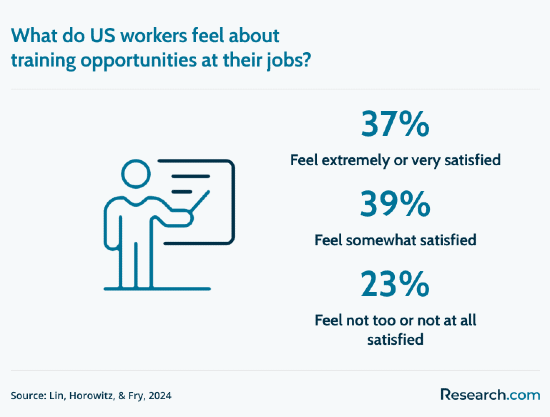

But companies keep slashing L&D headcount while deploying more tools that require training. Training staff payroll dropped 4% to $60.6 billion in 2024. Yet spending on outside training products surged 23% to $12.4 billion.

The budget didn't disappear. It moved. And there's your opening.

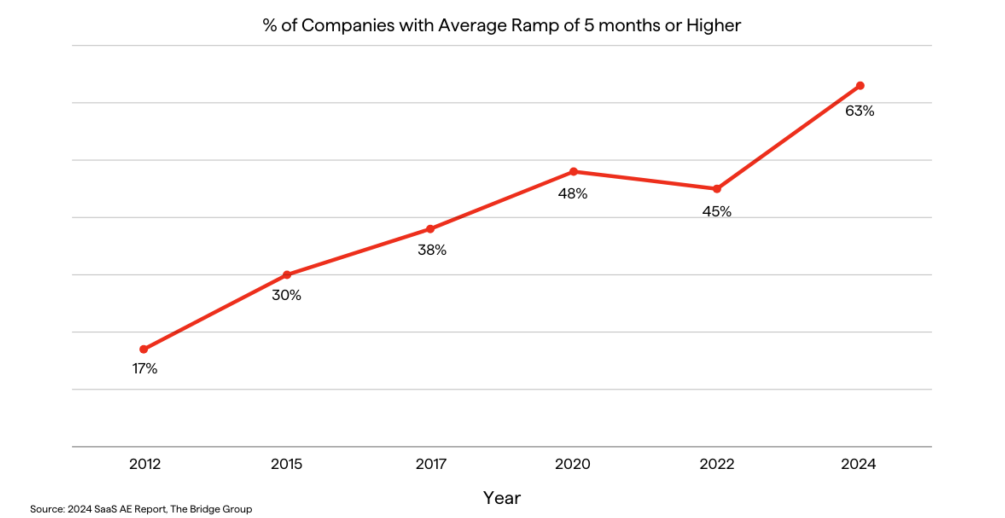

Companies still need new hires to ramp—whether they have a training team or not. They'll pay to solve it. You just need to sell them what actually works. Digital adoption platforms like WalkMe ($50K-$100K/year) show where to click but don't teach workflows. LMS platforms are too heavy for 200-person teams. And every "Season 1" you ship generates 12-18 months of retainer revenue keeping content synced as tools change.

Start as a high-touch implementation shop billing $15K-$40K per role. Add auto-update detection when Salesforce/Jira schemas change. Scale to $200K+ MRR within 18 months: 25 customers at $6K-$8K/month retainer generates $2M+ ARR before you add platform expansion revenue.

Fair warning: This is a hard business. You'll live in RevOps workflows, fight for budget against entrenched platforms, and spend months building process graphs that break every time a customer changes a field. The idea is solid. The execution will crush you if you're not built for it.

But if you are? The moat is real.

At every 100-person startup scaling past Series B, the same disaster plays out:

They hire 15 people in Q1. Everyone's remote. "Onboarding" is a Notion page someone updated 8 months ago, 23 Loom videos (11 broken), and a Slack DM: "just shadow Jamie for a few days."

Jamie left three weeks ago.

New SDRs fumble through Salesforce for a month. Support reps invent their own Zendesk workflows. The ops hire spends week two asking basic questions about fields that keep changing.

Meanwhile, the tools evolve. Salesforce adds required fields. Someone "optimizes" the JIRA workflow. HubSpot rules get rewritten. The person who knew how it all worked? Gone.

Your new hires don't learn the job. They learn workarounds. Your company becomes a museum of stale screenshots and broken Loom links.

Why timing matters

Ramp time is a six-figure tax per hire

Sales reps take 3.2 months to reach full productivity. Support and CS roles aren't faster. Every week someone spends lost equals lost revenue, wasted salary, management tax.

A $200K OTE rep who's 50% ramped for 90 days costs roughly $50K in opportunity cost alone. Replacing an employee runs about 33% of their base salary once you factor hiring, training, and lost productivity.

Shave 3 weeks off a 3.2-month ramp and you've paid for yourself twice over.

The tool stack is the new onboarding crisis

The average company uses 110-130 SaaS apps. Even sub-200-employee orgs run on dozens of tools. Every new hire touches 8-12 core systems in month one: Salesforce with your custom fields, Jira with your specific workflows, Zendesk with your macros, Slack with your channel conventions, plus internal tools with zero documentation.

Each tool gets updated quarterly. Fields change. Workflows shift. The "source of truth" becomes whoever answers fastest in Slack.

That's why digital adoption platforms are exploding—from roughly $620M in 2023 to a projected $3.6-3.8B by 2032-2034. WalkMe charges enterprises $50K-$100K+ annually. Pendo, Whatfix, and Userlane sit in the same range.

These platforms already own the budget line you're targeting. They sit in procurement systems. They have executive sponsors.

But they show where to click, not how work gets done. They guide users inside apps with pop-ups and walkthroughs. They don't explain your sales process, your deal approval flow, or why this field matters for forecasting.

That gap is your wedge.

The format already has demand (but everyone's building the wrong thing)

AI video platforms openly push onboarding and training use cases. HeyGen and Synthesia both market heavily to corporate training teams. Over 90% of Fortune 100 companies use Synthesia for training content.

The tech works. The buyers believe in it.

But most implementations are just prettier Loom—screen recordings with AI voiceovers. That's a feature anyone can copy.

The real business isn't video generation. It's owning the process graph.

The actual product: three layers that build a moat

If you want this to be a company, not a feature:

Unlock the Vault.

Join founders who spot opportunities ahead of the crowd. Actionable insights. Zero fluff.

“Intelligent, bold, minus the pretense.”

“Like discovering the cheat codes of the startup world.”

“SH is off-Broadway for founders — weird, sharp, and ahead of the curve.”