A tech billionaire turns his morning routine into content.

Every day: biomarkers, supplements, data. A ritual so quantified it crosses from health into performance art. The internet doesn't call him crazy. They ask: "Where do I sign up?"

Now picture that same energy—but aimed at the family dog.

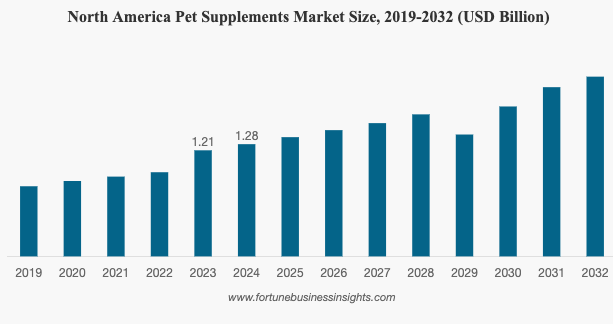

The pet supplement market sits at $2-3 billion today, climbing toward $5 billion by 2030. Zesty Paws sold for $610 million in 2021 doing just over $100 million in revenue—and that was before "longevity protocol" became a mainstream meme. The category is massive, growing fast, and completely fragmented. Nobody owns the language yet.

Most people won't drop $79/month to optimize their own cellular health. But they'll absolutely pay it to buy two more good years with their Golden Retriever.

The window is open because the science is suddenly real, the money is already moving, and the category still doesn't have a default brand. You're building the longevity protocol for dogs before anyone else names it. A measured, trackable, recurring system that turns scattered wellness products into a single operating dashboard—complete with a "Healthspan Age," quarterly reports, and a subscription loop owners won't cancel.

The next 18-24 months is the window. You're early enough to own the language before a major pharma brand defines it (Loyal's launch is likely 2026), late enough to point to credible signals without sounding like a crank, and ahead of the big pet food conglomerates building their own longevity platforms. Once Loyal or a competitor gets FDA approval and launches with mass-market distribution, the category definition window closes. You want to be the established protocol before that happens.

The wedge

Don't sell pills. Sell the score.

The "billionaire dog longevity" meme is a marketing asset, but it's not the business. The business is what's hidden inside the meme: longevity is a protocol, not a product.

The winning offer:

- A simple intake (breed, age, weight, diet, activity, environment, medical history)

- Optional testing (at-home gut microbiome kit; vet-partnered blood panels for biomarkers)

- An output you can share: "Healthspan Age: 7.2 (down from 8.6)"

- A personalized protocol organized by function:

- Metabolic support (weight management, cellular efficiency)

- Joint mobility (glucosamine, omega-3 combinations)

- Gut health (probiotics, digestive enzymes)

- Behavior levers (activity targets, sleep optimization, dental care)

- Quarterly check-ins that update the score and adjust the plan

- A shareable "Blueprint Yearbook" report (people will post this)

You're taking a chaotic aisle of products and repackaging it into one coherent system people subscribe to. The system is the moat.

Why now

The wave is here—you're just early enough to brand it

Pet spending remains enormous and stable.

U.S. pet industry spending hit $152 billion in 2024 and is projected to reach $157 billion in 2025, according to the American Pet Products Association. Even through inflation and economic uncertainty, pet care holds. The number of pet-owning U.S. households climbed from 82 million in 2023 to 94 million in 2025.

Supplements are growing, but trust is thin.

The global pet supplements market sits around $2-3 billion today, with projections climbing toward $3-5 billion by 2030. Multiple market research firms peg growth at 5-6% annually. Demand is obvious, but quality standards and "the default brand" don't exist yet. Category-owners get minted in exactly this environment.

The science is no longer just vibes.

The Dog Aging Project—a collaborative, NIH-funded effort led by Texas A&M and the University of Washington—is running the TRIAD trial (Test of Rapamycin In Aging Dogs). This is a rigorous, placebo-controlled, double-blind study with a target enrollment of 580 dogs. It's studying whether rapamycin, an mTOR inhibitor, can extend canine lifespan and improve healthspan metrics. The trial received a $7 million NIH grant in early 2025 and is set to conclude in 2029.

Rapamycin—often called the "universal anti-aging drug"—has been used for decades as an immunosuppressant in organ transplants. At low doses, it appears to improve cardiac function, cognitive function, and mobility in dogs, while extending lifespan in lab models from mice to worms.

This isn't speculative. It's peer-reviewed, government-backed research published in GeroScience and actively enrolling dogs across the U.S. Whether rapamycin works or not, the trial does something more valuable: it teaches millions of owners a new question—"What's my dog's healthspan plan?"

Biotech is about to mainstream "dog longevity."

Loyal, a San Francisco-based biotech, has raised over $150 million and is developing three longevity drugs for dogs. In February 2025, the FDA granted "Reasonable Expectation of Effectiveness" (RXE) acceptance for LOY-002, a daily pill targeting metabolic dysfunction in senior dogs aged 10+ years.

This is the first time the FDA has formally acknowledged that a drug can be developed and approved to extend lifespan in any species.

Loyal is pursuing the FDA's expanded conditional approval (XCA) pathway—designed for drugs addressing unmet medical needs that require long or complex studies. The pathway allows drugs that have demonstrated safety and "a reasonable expectation of effectiveness" to enter the market while collecting additional effectiveness data.

The company expects to complete manufacturing and safety requirements for conditional approval by late 2025, with a potential market launch in 2026.

Loyal's drugs function as the best kind of marketing: they prime the market to expect longevity solutions for dogs. The conversation shifts from "if" to "when" and "which protocol."

You don't need to win the drug race. You need to own the protocol layer that sits above it.

The regulatory trap (and how to not die in it)

If you sell a product that claims to treat, cure, prevent disease, or extend lifespan, you're drifting into "drug" territory fast. The FDA is explicit: there is no "dietary supplement" category for animals. Products are regulated as food or animal drugs depending on intended use.

The 1994 Dietary Supplement Health and Education Act (DSHEA) doesn't apply to animals. The FDA made this clear in 1996, and courts have upheld it. So products marketed as "dietary supplements for animals" are either food or animal drugs, period.

The correct positioning:

- "Healthy aging" / "healthspan support" / "wellness protocol"

- Data-driven risk factor tracking and vet-mediated decisions

- Clear disclaimers: you're not diagnosing or treating—your platform organizes information and supports wellness routines

The dashboard shifts you from "miracle pill" into "measurement + adherence + care coordination."

The business model

Two plays: a fast cash wedge and a compounding platform

Play A: The "heist" (0 → $20K MRR in 90 days)

Unlock the Vault.

Join founders who spot opportunities ahead of the crowd. Actionable insights. Zero fluff.

“Intelligent, bold, minus the pretense.”

“Like discovering the cheat codes of the startup world.”

“SH is off-Broadway for founders — weird, sharp, and ahead of the curve.”