It's 9:30 pm in Midtown Manhattan and there's a line out the door—for people who don't want to talk to anyone.

They're waiting for Ichiran, a ramen shop where you sit in a solo wooden booth, fill out a paper form, and noodles materialize through a curtain like an offering from the noodle gods. No small talk. No "still working on that?" Just you and a bowl.

What started as a "weird Japanese thing" is now a flex. Gen Z calls it a self-care date. Millennials call it sanity. Yelp calls it a tidal wave.

Searches for "solo dining" are up 271% year-over-year. Searches for "best place to eat alone" are up 150%.

Here's the punchline: about a quarter of Americans now eat all their meals alone on a given day—up more than 50% since 2003.

Meanwhile, U.S. restaurant sales are projected to hit $1.5 trillion this year.

There's a giant river of solo spending flowing through an industry still optimized for two-top date nights.

That's the heist.

The Market: Real, Growing, Under-Served

Let's do the math.

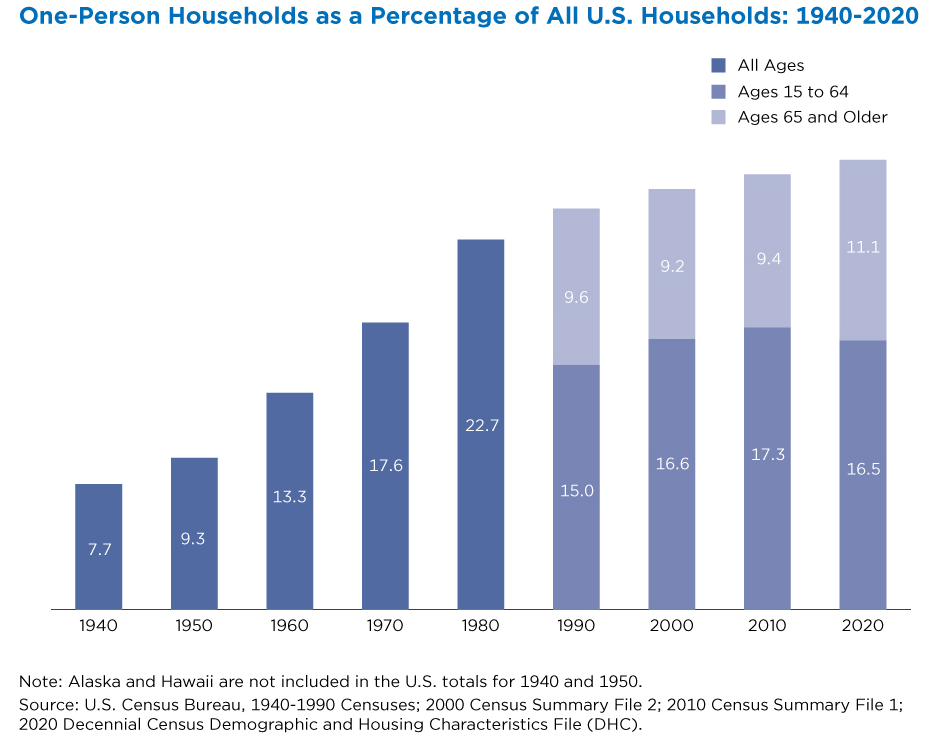

The U.S. now has 39.7 million one-person households—29% of all homes, up from 20% in 1975.

Solo dining isn't a niche behavior anymore. According to TouchBistro's 2025 Diner Trends Report, 21% of Americans typically dine out solo, and 29% dine alone at least once a week. Among younger demographics, it's even more dramatic: 49% of millennials and 46% of Gen Z report eating out alone weekly.

Toast's Q3 2025 data shows solo dining reservations spiked 22% year-over-year—though they still represent less than 1% of total bookings.

That's not a problem. That's the opportunity: massive growth rate on a small base means we're at the very beginning of the adoption curve.

But here's the number restaurant owners actually care about: solo diners spend 48% more per person than average diners, with an $84 average check.

They're easier to serve. They're more willing to try new dishes. They don't split bills or negotiate over apps.

This isn't a "$150B market" in the traditional TAM sense—but there's clearly a credible path to building a mid-eight to nine-figure infrastructure and data business if you can prove restaurants will pay for solo optimization and you can capture structured data at city scale before incumbents do.

The Gap: Demand Is Huge, Infrastructure Is Dumb

Right now, the ecosystem looks like this:

Discovery layer: Yelp, Google, OpenTable are great at "best tacos near me." They're useless at "where can I eat alone without feeling like a creep."

Restaurant behavior: Split into two camps:

- Anti-solo: "No solo diners," minimum two dishes, passive-aggressive bar steering. Some have policies that have gone viral and pissed people off.

- Solo-friendly pioneers: Ichiran-style booths, smaller tables, solo tasting menus, intentional seating design. They're quietly printing per-seat profit.

There's no standard. No scoring. No shared language for: "Is this place actually good for eating alone?"

The big platforms are aware of this trend—Yelp and OpenTable both publish solo dining guides and editorial content. But they surface it as content, not infrastructure. There's no shared, machine-readable score or certification that operators can invest in and consumers can filter by.

That's the gap.

The Play: Own the Schema

A simple "solo dining app" is a feature. The real heist is owning the schema:

Unlock the Vault.

Join founders who spot opportunities ahead of the crowd. Actionable insights. Zero fluff.

“Intelligent, bold, minus the pretense.”

“Like discovering the cheat codes of the startup world.”

“SH is off-Broadway for founders — weird, sharp, and ahead of the curve.”