In November 2025, Jason Gyamfi filmed a 15-second video in Brooklyn. He wore a navy quarter-zip sweater and held an iced matcha. "We don't do Nike Tech, we don't do coffee," he announced. "It's straight quarter-zips and matchas around here."

That video hit 23 million views. Complex, NPR, The Washington Post, and GQ covered it as a cultural movement. IRL meetups started happening. The internet figured out that identity is inventory.

When men buy quarter-zips, they're buying "Quarter-Zip Guy"—the full package of maturity signals, economic aspiration, and community belonging. The sweater? Just the SKU. What they're actually purchasing is an identity kit they can inhabit.

This opens a wedge into a $130+ billion U.S. menswear market ripe for disruption. The winning businesses will sell compilations of who you become when you wear them.

The signal hiding in plain sight

GQ documented the quarter-zip phenomenon in their 2025 menswear trends report. They didn't frame it as fashion—they framed it as identity performance. The publication that once dictated what men should wear now catalogs what men are already doing to signal belonging.

Fortune connected the dots to economics: entry-level job postings dropped 29% in 2024 while applications per opening doubled. Quarter-zips became career camouflage. $25 on Amazon delivers the same signaling effect as $100+ Nike Tech. The quarter-zip functions as economic semaphore.

The cultural logic tracks. TikTok views on quarter-zip content passed 50 million. IRL meetups happened in multiple cities. Media coverage went from meme documentation to trend analysis to cultural commentary. This moved beyond internet jokes into infrastructure for young men building professional identities in a hostile job market.

One uniform proves the mechanism. The pattern scales across every identity container that offers social legibility at accessible price points.

Why uniforms beat trends

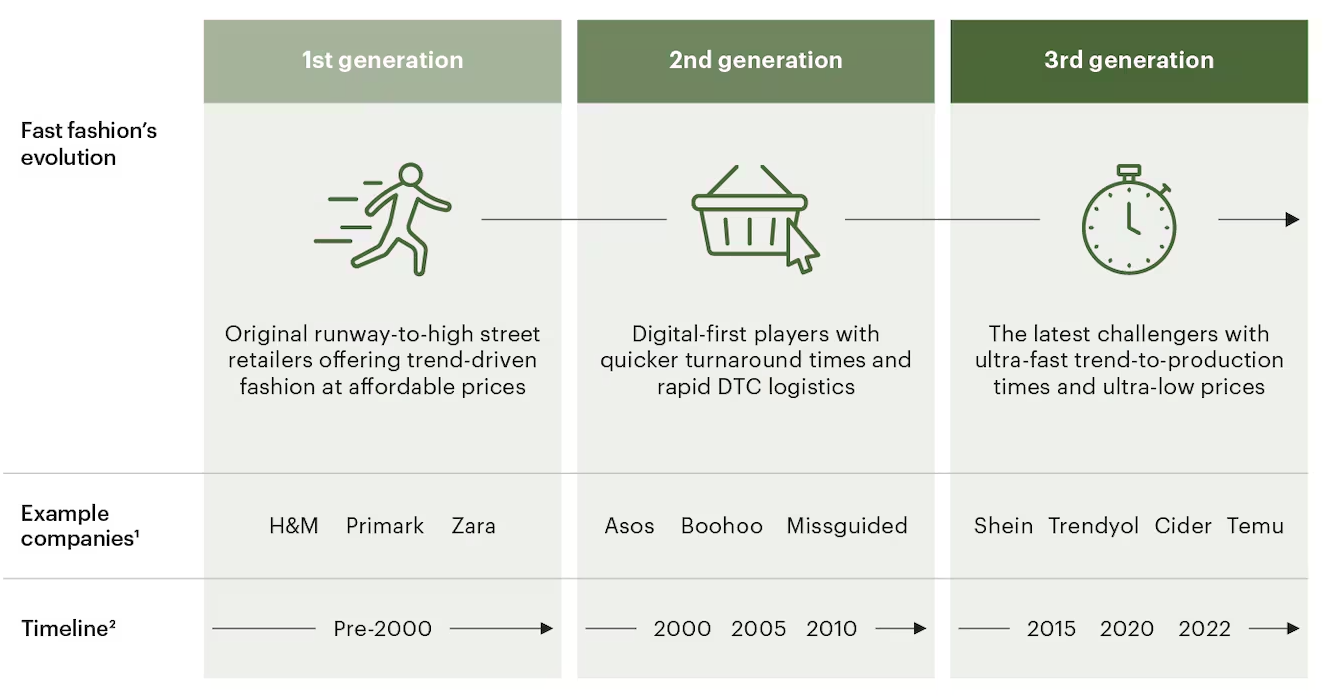

The menswear market keeps accelerating. The U.S. market reached $130-155 billion in 2024, projected to hit $190-260 billion by 2033. Global menswear sits at $595-624 billion. The market structure matters more than the market itself.

Traditional fashion microtrends exhaust consumers. They burn out in 3-5 months. Pop culture-tied trends last half that. Meme-based aesthetics die even faster. The entire category is collapsing under its own weight. WGSN's fashion forecasters noted in early 2025: "We were on a hamster wheel and we couldn't get off it."

BoF reported fewer viral aesthetics in 2024 than 2023 or 2022. Consumer fatigue is real. People are tired of buying for trends that die before the package arrives.

Uniforms operate differently. They signal membership rather than novelty. Quarter-Zip Guy doesn't expire when Boat-Shoe Creative shows up—you might become both. Instead of disposable aesthetics, you get stackable identities.

What men actually buy (and why legacy brands miss it)

Men don't shop like women. The average U.S. male buys 20 new menswear items per year. They hate the process. They want it solved, not explored.

Bonobos figured this out in 2007. Two MBA students noticed men couldn't find pants that fit. The problem wasn't trends or styles—just pants that didn't create "diaper butt." They designed a curved waistband, sold direct online, and hit $300 million in revenue before Walmart paid $310 million for the company.

Untuckit built $100+ million in annual revenue on an even simpler insight: shirts designed to be worn untucked. That was the entire pitch. One problem, solved. They opened 86 stores and became profitable in secondary markets—Jacksonville, Albuquerque, Kansas City—precisely because they sold solutions instead of fashion.

Both brands operated on what Bonobos founder Andy Dunn called "narrow and deep" strategy: "Consumers don't need many things from your company—they just need one thing from your company."

The quarter-zip uniform does this at scale. The entire performance of professional aspiration, one cart click.

The wedge: Meme Uniform Shop

Build a shop that turns internet identities into buyable kits.

The uniform as unit economics:

- 2-3 base silhouettes that never change (quarter-zip, oxford, chino)

- Identity bundles with names: "Quarter-Zip & Matcha," "Boat-Shoe Creative," "Post-Streetwear Office Villain"

- Weekly drops = ritual + scarcity

- Each bundle: 2-4 items, $148-268 price point

The advantage: naming and packaging stable identity containers instead of chasing microtrends. Quarter-Zip Guy works as a durable persona. The persona persists while you rotate colorways and materials.

Inventory strategy that won't kill you:

Apparel returns run around 26% industry-wide. Fit is the villain. Minimize risk:

- Core pieces only: Stock tops (largest menswear segment by revenue). Everything else—accessories, novelty items—runs through affiliate or print-on-demand.

- Silhouette consistency: The quarter-zip fit never changes. Same supplier, same patterns, same sizing. Only story + colorways rotate. This is how you ship weekly without drowning in SKU chaos.

- Pre-orders for expansion: Test demand before committing to inventory. Drops can include "reserve now, ships in 2 weeks" items.

ThreadBeast and Bespoke Post proved men will pay for "someone pick for me." Same approach, meme-native packaging.

The moat: Identity Graph → Silhouette System → Creator Distribution

Fashion businesses typically have no defensibility. Styles get copied. Suppliers are shared. Distribution is commoditized.

The uniform economy builds three compounding advantages:

Unlock the Vault.

Join founders who spot opportunities ahead of the crowd. Actionable insights. Zero fluff.

“Intelligent, bold, minus the pretense.”

“Like discovering the cheat codes of the startup world.”

“SH is off-Broadway for founders — weird, sharp, and ahead of the curve.”